ASK YOURSELF...

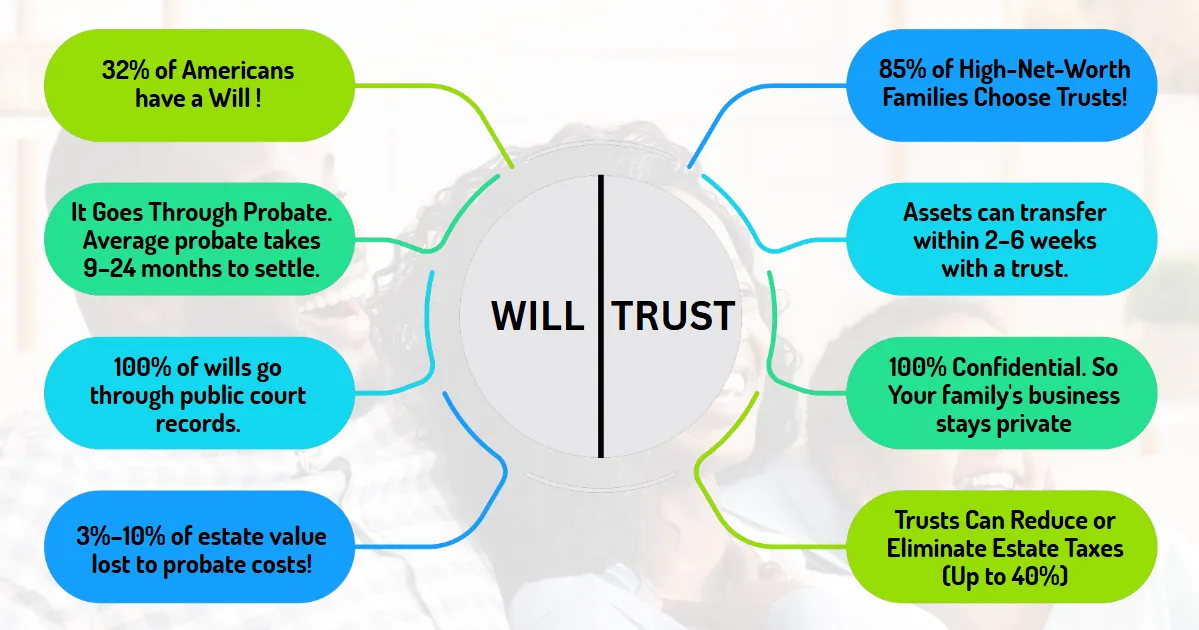

Have you ever wondered what a Trust is and why you should choose that instead of a Will?

Can you imagine losing your home just because you needed long-term care? What would it mean to protect it before it’s too late?

How empowering would it be to know exactly which of your assets can go into a trust, and which ones should stay out?

Do you think your mortgage stops you from protecting your home with a trust? What if that’s just a myth?

Do you know what the real difference is between a revocable and irrevocable trust and how each one could protect your future?

How much peace of mind is a trust worth to you, and is it more affordable than you think?

Could your most trusted family member actually serve as your trustee, or would it create more stress than solutions?

Who would you trust to manage your legacy if something happened to you, and what backup plan do you have in place?

What if putting your house in a trust meant your kids might lose out on tax savings, are you prepared for that tradeoff?

Take This OPPORTUNITY And...

Join the many who've secured their wealth with enduring trusts. Because Your legacy deserves more than hope, it deserves a solid plan.

The Top 5 Benefits of a TRUST

Feel the pride of watching your legacy grow, just like the wealthy do.

Sleep soundly knowing your home, savings, and everything you’ve built are safe from unexpected threats.

Enjoy Tax Breaks like the wealthy and feel the satisfaction of keeping more of your money, using the same strategies the ultra-rich rely on.

Imagine your family skipping courtrooms and stress. You decide who gets what, when, and how, no guesswork, no chaos.

Breathe easy with a plan that evolves as life changes, because control should always stay in your hands.

WHAT YOUR LIFE LOOKS LIKE WITH A WILL VS A TRUST

Do You Want To Make Your Life Evergreen?

What would it cost your family, emotionally and financially, if the courts decided your legacy, not you?

How would it feel to finally stop overpaying taxes and start building generational wealth, legally, and on your terms?

What’s peace of mind worth, knowing you’re in full control now and your loved ones will never be left in confusion later?

What if one simple decision today meant your child’s dreams could survive divorce, debt, or disaster tomorrow?

All You Need Is a Revocable Trust

Protect what matters most

For just $1,000

a Revocable Trust

for just $1,000

Remember, this is the last time we're doing establishing TRUST for others!

Need more information?

Our team is here to assist you.

Reach out to us anytime!

Text 910-999-1923 or Email us at [email protected]